Cost of Goods Manufactured Formula

To perform the COGM calculation you need to identify the three important calculation parts. 00 per unit 56000 86000 Total manufacturing costs 198000 Add.

Cost Of Goods Manufactured Formula Examples With Excel Template

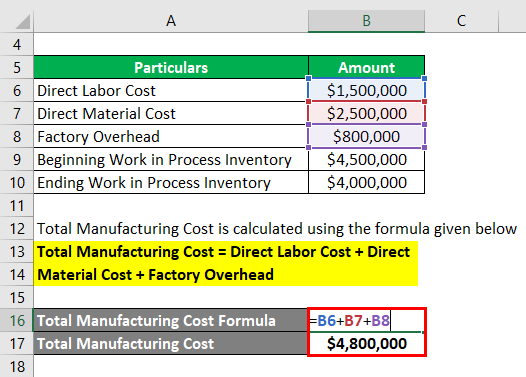

Prime Cost Direct Materials Cost Direct Labor Cost Total Factory Cost or Manufacturing Cost Direct Materials Direct Labor.

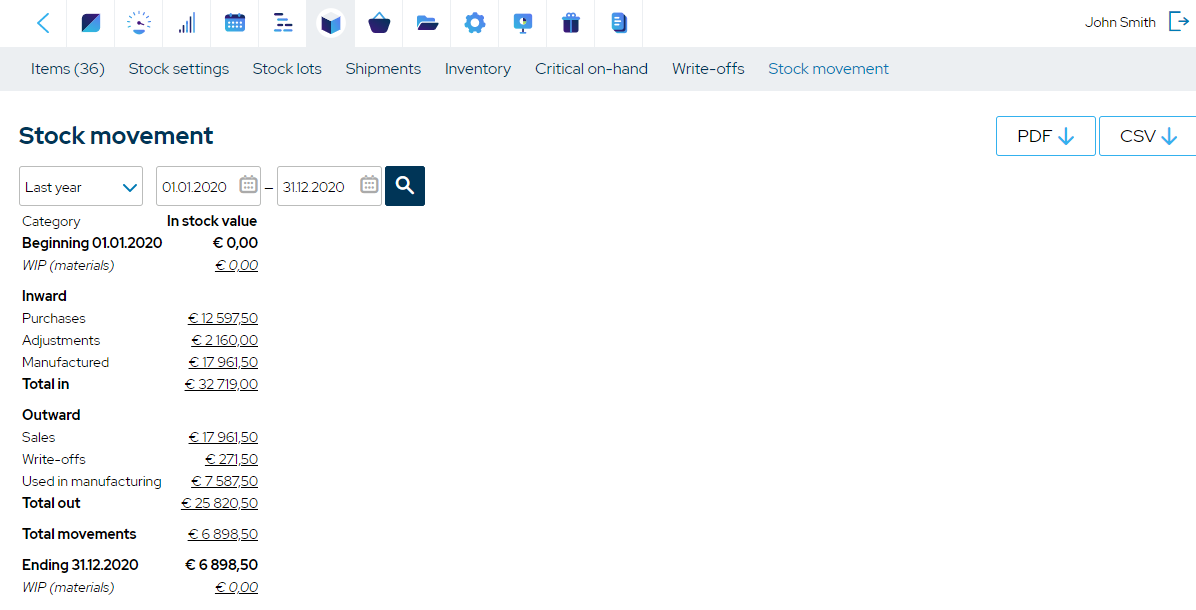

. COGM Beginning work in. You need to find out the number of finished goods on hand at the. How To Calculate Cost Of Goods.

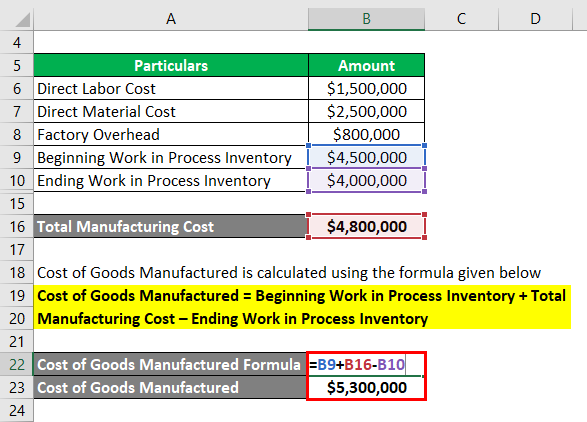

The following is the formula used to calculate the cost of goods manufactured along with a breakdown of what each piece of the formula means. Definition of Cost of goods manufactured or COGM. The formula to calculate COGM Beginning WIP inventory total manufacturing cost - ending WIP inventory.

This equation is sometime referred to as COGM formula. Step by step formula There are a variety of components youll need to correctly calculate production costs but first youll want. The most likely reason for differences between the costs of goods manufactured and sold is simply that the mix of products sold does not exactly match the mix of products.

So here is the cost of goods manufactured formula COGM Beginning WIP inventory total manufacturing cost ending WIP inventory. Work in process ending 0 Cost of goods manufactured 198000. How to calculate the cost of goods manufactured.

The cost of goods manufactured can be found out by. And finally we get the Cost of Goods Manufactured by adding the Beginning WIP Inventory to the Total Manufacturing Cost and subtracting the Ending WIP Inventory. The Cost of Goods Manufactured is the total manufacturing costs of goods that are finished during a certain accounting period.

COGM 12000 96200. Cost of goods manufactured COGM may also be expressed in the form of an equation. The formula for calculating the Cost of Goods Manufactured COGM is.

The Cost of Goods Manufactured COGM is a statement that shows the total cost of producing products for a. Cost of Goods manufactured Direct materials cost Direct labor cost Factory overhead cost Opening work in process inventory. Cost of Goods Manufactured and Sold Statement Formulas.

These costs include direct materials direct labor and manufacturing overhead of the products that are transferred from the manufacturing department to the finished goods. Ending InventoryThe ending inventory formula computes. The Choco began the year with a 4000 amount of beginning work-in-process inventory.

For Great Star Factory that calculation is 6000 24000 -. It then adjusts these costs for the change in the WIP inventory account to arrive at the cost of goods manufactured. Number of units manufactured Units sold Ending Finished Goods units.

The ending work-in-process inventory is. Total Factory Cost or Manufacturing Cost Direct Materials Direct Labor Cost Factory Overhead. Work in process beginning 0 198000 Deduct.

COGM Direct Materials Used Direct Labor Used Manufacturing Overhead Beginning Work in. A break down of this schedule can be visualized below. Manufacturing overhead cost is 2500.

How To Calculate The Cost Of Goods Manufactured Cogm Mrpeasy

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Template Download Free Excel Template

No comments for "Cost of Goods Manufactured Formula"

Post a Comment